Profit+

Value (+profit, +wealth) is captured by those who can create and it.

Here is an insight on what’s shifting in the world and how it can shape the way you think, act, and lead globally.

Some leaders are talking about purpose. Most are talking about profit. In many instances, both are wanted, yet profit is the priority in the current economic climate.

The McKinsey Global Institute’s report, The Next Big Arenas of Competition, identifies 18 high-growth “arenas” projected to reshape the economy and generate USD 29 to 48 trillion in revenue by 20401. This forecast has significant implications for businesses across all sectors worldwide and highlights an important question:

How can businesses align with new value drivers and capture profit sustainably?

Ugh, Profit!

Mentioning monetary measures such as revenue or profit raises concerns among a number of readers as profit-driven capitalism faces widespread criticism (Hi!👋)2.

Yet, in an environment marked by economic contraction, budget cuts, and restructuring for productivity gains, profit remains essential for reinvestment and sustained impact. Without profitability or reliable funding sources, even the most purpose-driven organizations eventually face limits dictated by donors or financial backers3.

Within the current economic system, profit provides autonomy, enabling businesses to act with greater independence and purpose.

The Profit+ Model

The Profit+ model combines profit with purpose while leveraging ongoing economic shifts that drive performance today. Leaders focused solely on purpose often face constraints when funding dwindles or donor priorities shift. Profit+ goes further, positioning financial returns as a means to address real-world problems and sustain impact. By aligning purpose with profit and actively capturing new value, leaders who understand and respond to economic shifts are equipped for long-term, sustainable performance that meets both commercial as well as societal, health, educational, and environmental goals.

Value, Profit, and Wealth: Unevenly Distributed

It’s well known that value, profit, and wealth are captured unequally4.

Oxfam’s research shows the reality of this distorted distribution. The five richest individuals have more than doubled their wealth since 2020, with billionaires collectively gaining USD 3.3 trillion, outpacing inflation threefold. Meanwhile, large corporations have also seen record profits. In the year leading up to June 2023, 148 of the world’s biggest companies generated USD 1.8 trillion in profits - an 89% increase compared to 2017-2020 averages. This disparity confirms:

Value (and profit, and wealth) is captured by those who can create and capture it.

A key first step to creating and capturing value - and to distributing profit and wealth more equitably - is to identify where value is being generated today and where it is likely to emerge in the near future.

Key Drivers of High-Growth: New or New Normal?

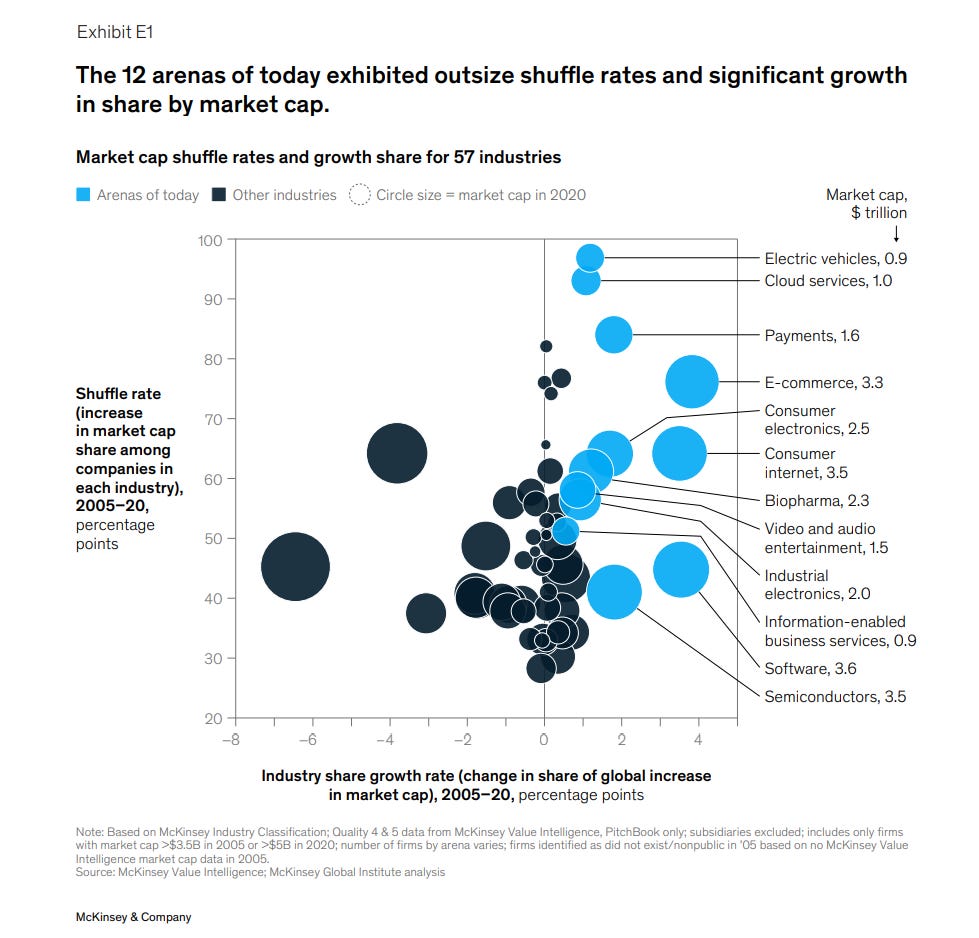

The McKinsey report highlights 18 arenas that could together account for 10-16% of global GDP by 2040, up from 4% today. These include sectors like AI, cybersecurity, future mobility, biotechnologies, and modular construction - industries marked by rapid growth, significant investment, and increased competition.

It’s valuable to understand the key drivers behind these high-growth growth arenas. They are increasingly not new, rather they represent the new normal in the global business environment.

What Shifts? Key Drivers of High-Growth Arenas

McKinsey identifies three main factors that fuel these high-growth arenas. The represent key shifts that will have ripple effects, impacting how organizations of all sizes can implement a Profit+ model:

Technological or Business Model Shifts: When technologies or business models reach a maturity threshold, they enable transformative growth. This often follows an S-curve: slow at first, then accelerating rapidly as it matures. Lithium-ion batteries in EVs illustrate this, moving from niche to mainstream as adoption rates surged and costs dropped. As these technologies become accessible, new tools and services emerge that enhance productivity, allowing organizations of all sizes to pursue purpose-led goals with sustainable profitability.

Escalation Incentives for Investment: Strategic investments are essential for market growth, as they strengthen products and operations. Investments in R&D, marketing, or infrastructure create a cycle where improvements in scalability and appeal drive reinvestment. Early investments in cloud infrastructure, for instance, reshaped the tech sector, and new services that reduce cost barriers while improving efficiency will continue to open up opportunities for organizations to drive profitability and purpose.

Large, Expanding Markets: Growing markets create rich opportunities, particularly in sectors like digital healthcare, AI, and industrial electronics, where demand often exceeds the pace of general economic growth. These expanding sectors allow companies to develop adaptable solutions that quickly address emerging needs, while investments in tools and technologies make it easier for organizations to achieve productivity gains and pursue meaningful impact alongside profit.

Collectively, these drivers form arenas marked by intense competition and high potential for outsized returns. In these spaces, early adoption, reinvestment, and understanding of value creation are key to capturing profit.

Turning Shifts into Strategic Advantage

Navigating these economic shifts requires strategic adaptation. Here’s three steps to make a start:

Understand Arena Impacts: Assess how trends in each high-growth arena connect to your business. By identifying specific opportunities and threats, you can align your strategy for a competitive edge. Consider which of McKinsey’s 18 arenas hold the most relevant opportunities and how your approach might capture value.

Identify Winners: Spot emergent leaders building strong models with high-growth drivers. Options include competing directly or creating complementary service offerings in adjacent spaces that leverage your existing competitive advantage.

Adopt Futures Thinking: Preparing for multiple futures enables adaptability. Instead of predicting exact outcomes, consider first- and second-order effects across McKinsey’s arenas to identify early shifts and make proactive adjustments.

Value, Profit, and Wealth: A Model for Positive-Sum Success

Profit (and value, and wealth) generation isn’t a secret. The projected USD 29 to 48 trillion in new revenue by 2040 won’t be equally distributed - only those with insight and strategy will capture this value, and they can choose to distribute it equitably if they wish.

Success requires going beyond doing more of the same or discussing ideas in familiar settings. It isn’t found inside echo chambers or by maintaining the status quo.

A Practical, Actionable Strategy

Profit+ is accessible to all businesses. It’s about combining purpose with profitability through a practical, leveraged, global strategy.

There is more to the world than what we see.

The world is unfolding around us, with winners and losers emerging.

By expanding our worldview to gain understanding, we can then focus on strategic action.

We can capture wins while supporting the market (or people, or purpose) we care about.

As the world and economic landscape evolve, those who understand - and act on - how value is created will be best positioned for positive-sum success. Until broader economic changes take hold, profit-driven strategies that solve real-world issues while leveraging today’s economic shifts will remain essential, providing resilience and a sustainable path to impact.

Do you want more purpose - and profit - in your business, and do you expect to secure it in new ways as the future unfolds?

https://www.mckinsey.com/mgi/our-research/the-next-big-arenas-of-competition

https://bristoluniversitypress.co.uk/alternatives-to-capitalism-in-the-21st-century

https://link.springer.com/article/10.1057/s41299-021-00122-8

https://www.weforum.org/agenda/2024/01/corporations-fuelling-inequality-economy-profits/